this post was submitted on 28 Aug 2024

844 points (98.8% liked)

Facepalm

360 readers

2 users here now

Anything that makes you apply your hand to your face.

founded 3 months ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

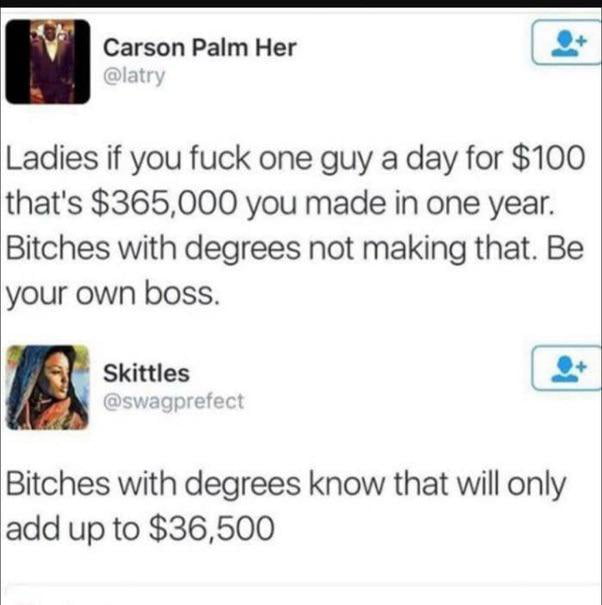

I hope you pay an accountant to do your taxes, because that's way, way off.

If you earn $60k in a state like, NY, your take home amount will be $45,363

CA: $47,763

TX: $49,949

There are different countries with different taxes. And in some they can get close to 50%

Marginal tax rate in California is about 50% for highest bracket (37% federal + 12.3% state).

But 60k is nowhere near that number of course (and effective tax rate is lower than marginal). I'd be surprised if there are any countries where income at ~4x poverty line (for an individual) would have anything near a 50% tax rate, but I could be wrong...

that CA tax was copied from the us tax office website's calculator. It does it by city, not just state, which I thought was interesting. (That number was from San Fran)

Out of curiosity, I looked up one of the highest taxed countries in the world: Finland.

$60,000usd = 54,133.80 Euro, with a take home of only € 31,447 (averaged tax rate of 41.9%, 53.2% on the marginal), which is $34,850usd

So, if Vampire@hexbear was thinking about Finland...

He gets a pass. (He wasn't, and OOP was using $, not €, but your point is otherwise valid!)

yes and no. Yes, you can get up to 98% tax rate, I'm sure - but that's not how tax brackets work.

also, OOP is from the USA.

GB: ~£45,000 also

but £60,000 is a lot more than $60,000usd, so I'd expect the overall rate to be higher.

so, while yes, take home would be £45,361, if it were the same...

$60,000usd = £45,575, which take home would be £36,335.40, which in USD would be $47,834

making the two countries basically the exact same for taxes.