Image is from this SCMP article.

Much of the analysis below is sourced from Michael Roberts' great website.

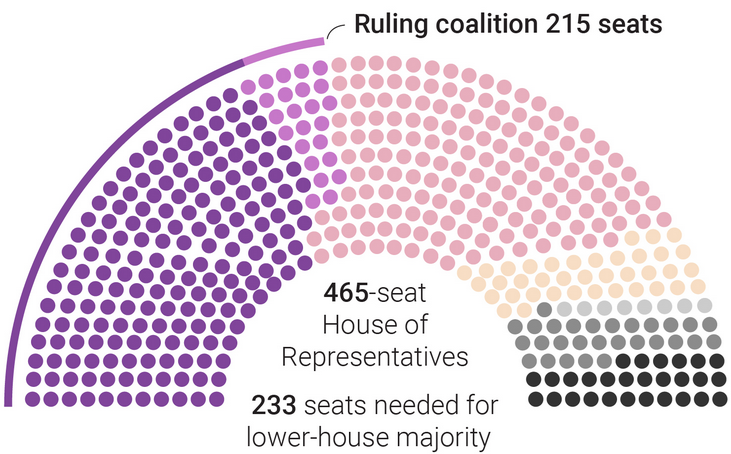

Japan's ruling parliamentary coalition, consisting of the LDP (purple) and it's junior coalition partner Komeito (in light pink) have lost their ruling majority. They have ruled post-war Japan for almost its entire history. The LDP is currently led by Shigeru Ishiba after Kishida stood down due to a corruption scandal, and ties to the Unification Church.

While geopolitical factors (over the cold war between the US and China, etc) may have played a role, by far the biggest reason for this result in the poor economic conditions over the past few years. Inflation has risen and real wages have fallen, with little relief for the working class via things like tax reductions. While inequality in Japan is not as extreme as in America, it is still profound, with the top 10% possessing 60% of the wealth, while the bottom 50% possess just 5%.

Shinzo Abe previously tried to boost economic performance through monetary easing and fiscal deficits, while Kishida ran on a "new capitalism" which rejected Abe's neoliberalism and promised to reduce inequality. Nothing substantial has resulted from all this, however, other than increasing corporate wealth. Innovation continues to fall, and domestic profitability is low, resulting in decreasing investment at home by Japanese corporations. Labour productivity growth has only slightly picked up since the mid-2000s and is falling again. The rate of profit has fallen by half since the 1960s, and Japan has been in a manufacturing recession - or very close to it - since late 2022. In essence: there is no choice but between stagnation or decline.

Please check out the HexAtlas!

The bulletins site is here!

The RSS feed is here.

Last week's thread is here.

Israel-Palestine Conflict

Sources on the fighting in Palestine against Israel. In general, CW for footage of battles, explosions, dead people, and so on:

UNRWA reports on Israel's destruction and siege of Gaza and the West Bank.

English-language Palestinian Marxist-Leninist twitter account. Alt here.

English-language twitter account that collates news.

Arab-language twitter account with videos and images of fighting.

English-language (with some Arab retweets) Twitter account based in Lebanon. - Telegram is @IbnRiad.

English-language Palestinian Twitter account which reports on news from the Resistance Axis. - Telegram is @EyesOnSouth.

English-language Twitter account in the same group as the previous two. - Telegram here.

English-language PalestineResist telegram channel.

More telegram channels here for those interested.

Russia-Ukraine Conflict

Examples of Ukrainian Nazis and fascists

Examples of racism/euro-centrism during the Russia-Ukraine conflict

Sources:

Defense Politics Asia's youtube channel and their map. Their youtube channel has substantially diminished in quality but the map is still useful.

Moon of Alabama, which tends to have interesting analysis. Avoid the comment section.

Understanding War and the Saker: reactionary sources that have occasional insights on the war.

Alexander Mercouris, who does daily videos on the conflict. While he is a reactionary and surrounds himself with likeminded people, his daily update videos are relatively brainworm-free and good if you don't want to follow Russian telegram channels to get news. He also co-hosts The Duran, which is more explicitly conservative, racist, sexist, transphobic, anti-communist, etc when guests are invited on, but is just about tolerable when it's just the two of them if you want a little more analysis.

Simplicius, who publishes on Substack. Like others, his political analysis should be soundly ignored, but his knowledge of weaponry and military strategy is generally quite good.

On the ground: Patrick Lancaster, an independent and very good journalist reporting in the warzone on the separatists' side.

Unedited videos of Russian/Ukrainian press conferences and speeches.

Pro-Russian Telegram Channels:

Again, CW for anti-LGBT and racist, sexist, etc speech, as well as combat footage.

https://t.me/aleksandr_skif ~ DPR's former Defense Minister and Colonel in the DPR's forces. Russian language.

https://t.me/Slavyangrad ~ A few different pro-Russian people gather frequent content for this channel (~100 posts per day), some socialist, but all socially reactionary. If you can only tolerate using one Russian telegram channel, I would recommend this one.

https://t.me/s/levigodman ~ Does daily update posts.

https://t.me/patricklancasternewstoday ~ Patrick Lancaster's telegram channel.

https://t.me/gonzowarr ~ A big Russian commentator.

https://t.me/rybar ~ One of, if not the, biggest Russian telegram channels focussing on the war out there. Actually quite balanced, maybe even pessimistic about Russia. Produces interesting and useful maps.

https://t.me/epoddubny ~ Russian language.

https://t.me/boris_rozhin ~ Russian language.

https://t.me/mod_russia_en ~ Russian Ministry of Defense. Does daily, if rather bland updates on the number of Ukrainians killed, etc. The figures appear to be approximately accurate; if you want, reduce all numbers by 25% as a 'propaganda tax', if you don't believe them. Does not cover everything, for obvious reasons, and virtually never details Russian losses.

https://t.me/UkraineHumanRightsAbuses ~ Pro-Russian, documents abuses that Ukraine commits.

Pro-Ukraine Telegram Channels:

Almost every Western media outlet.

https://discord.gg/projectowl ~ Pro-Ukrainian OSINT Discord.

https://t.me/ice_inii ~ Alleged Ukrainian account with a rather cynical take on the entire thing.

Fed seen on track for 25-basis-point rate cuts next week and in December

I’ve said it before and I’ll say it again: September’s first rate cut really marked the commencing of Phase 2 of US imperialist war against the rest of the world. This is quite possible the most evil plan that the US is about to pull.

As I’ve said before, the rate cuts will do two things: first, all the dollars sucked into the US capital market will flow into the foreign sector again, to make the Global South countries become addicted to the dollar again; and second, the rate cut will dry up the interest payment that had a huge contribution in the US deficit spending over the past two years, which can only mean a recession.

Remember when all the economics pundits crying about how Biden’s interest rate hike will cause a recession from 2022-2024? Well, they were all wrong. I’ve always said that the recession will happen after they start to cut the rate, and this is well timed to happen until months after the election (we won’t see the consequences until at least 6-9 months from now, depending on how fast the interest rate is being cut and how much deficit the Treasury is creating to compensate for that).

What to expect: many export-dependent countries are going to be economically crippled when the US goes into recession, as consumption and demands for goods and services slump. If the US can replicate the Global Financial Crisis of 2009, expect to see an explosion of IMF loans and waves of mass privatization across the Global South over the next few years.

These countries have been hit very hard since Covid, then the fallout of sanctions against Russia (commodity price increase), US fed rate hike (debt interest went up, investment capital outflows), they cannot sustain another shockwave like this.

The US will then exploit the crippled global economy to reshape the global supply chain to its own interest in its big fight against China. The economy over the next decade is likely going to be bad, and the outcome will be decided by a race to see who - the US or China - will get to reshape the global supply chain over the coming decades.

Fuck, this is so evil I cannot even begin to comprehend how ghoulish it must be to weaponize the global economy to retain its hegemony over the world. Unless China has some trump cards (I’m not seeing them), there’s no way we can escape from this. China’s monetary easing that was timed just after the US fed rate cut was a sign that even China, the strongest economy in the world in real terms, is afraid of what the US recession is going to do. This is the power of monetary imperialism.

The US is about to take a “big bite” on the globe.

(also BRICS has turned into a joke now, we shouldn’t expect to see a real challenge against US hegemony on that front as well)

Are all the low-interest loans China is exporting to periphery countries mostly in USD?

There are two types of Belt and Road loans: Infrastructure loans and Rescue loans.

Infrastructure loans are lent out for infrastructure projects, and are mostly in USD.

The reason is that by around 2013, China realized that accumulating US dollars through their huge trade surplus is the equivalent of collecting junk papers. The US doesn’t allow China (or any other country) to purchase critical assets and industries, so the surplus earnings are recycled back into US Treasuries to buy US debt (think of the Treasuries as a sink to absorb all the excess dollars America has spent overseas). China realized that instead of buying US bonds, they can lend out those dollars to other developing countries to build infrastructure, accumulate good will and utilize those dollars in a productive manner. However, in terms of de-dollarization, the outcome is the same: now it is the Belt and Road recipient countries that owe Chinese creditors in dollars, meaning that they have to earn dollars (by selling stuff to Americans or dollar-paying customers) to pay back their Chinese creditors. As long as China does not offer bailouts or debt cancellation, it makes no difference whether those dollars are kept in US Treasuries or circulated outside as infrastructure loans.

On the other hand, the Emergency Rescue loans are given out for countries in financial distress and can no longer pay back their debt in dollar, and are mostly in Chinese yuan. The prime example here is Argentina, whose dollar debt is so heavy that there is no way they can make their timely payments. So what China has been doing is to give out these Rescue loans in yuan (also sometimes using the IMF Special Drawing Rights) to rollover the dollar debt and keep refinancing and praying that something miraculous will happen by itself. It’s essentially the same as kicking the can down the road and trying to avoid the inevitable for as long as possible.

The exact proportion of Belt and Road loans in dollars is not made public, although I have seen from both English and Chinese sources (independent parties who did the calculations) that it’s about 70% USD.

On one hand, you can understand why China does this: unlike IMF or any America controlled institutions which the US can “print” an infinite amount of dollars and lend them out at any amount at will, the dollars held by the Chinese creditors came from the hard work of Chinese labor and resources and selling these goods and services to dollar-paying customers ($300 billion trade surplus from America every year), so it is understandable that China is not willing to give away their labor and resources for free.

On the other, China also needs to understand that there is no way these dollar debt can ever be repaid by the Global South countries. All these lending is only going to make the Belt and Road countries becoming ever more dependent on the US, who can create the dollars out of thin air, unlike China who has to earn them by making products for American consumers. The only way out is debt cancellation - cut your heavy losses and radically shift your position, and forget about being an exporter to the American economy. China is still unwilling to turn away from the US who has been their main source of wealth and prosperity over the years, and this is what gives the US such a strong hold over them.

Super interesting, thanks for such a thorough breakdown. If these countries that have received USD loans for B&R projects decided to pay those back to China in Yuan rather than USD, would there be any benefit in that? I guess that would mean they would be accumulating USD and would have to procure Yuan through other means to do it. But I wonder if like all these countries just held on to their USD and tried not to spend it, if that would then have an effect on the power of the treasury. Or maybe it would make things worse if we went into a recession, they’d have a lot of currency that would be worth less than it was when they received the initial loan?