this post was submitted on 02 Dec 2024

984 points (98.6% liked)

memes

10665 readers

1872 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

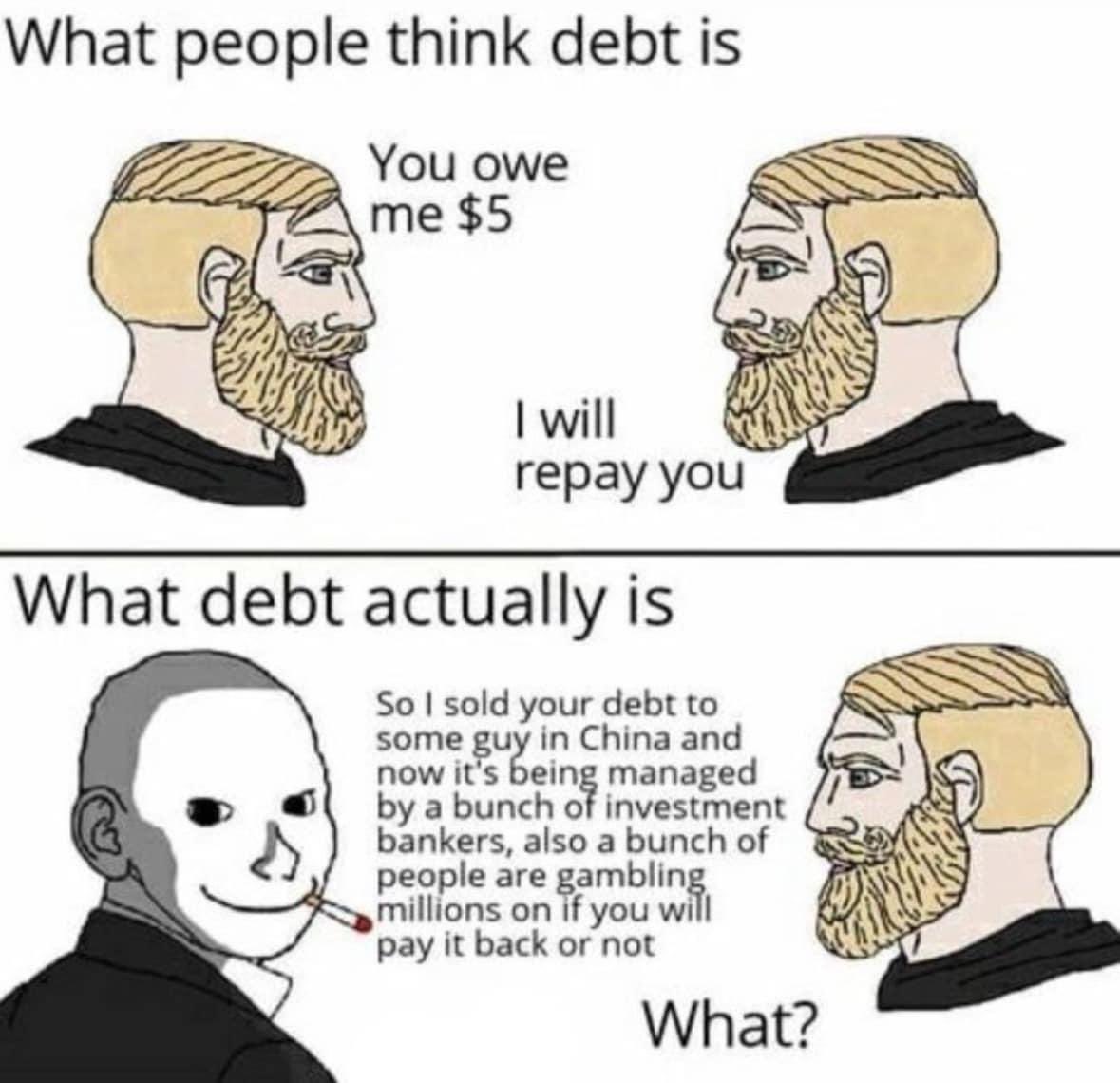

A left-leaning friend of mine who was big into economics and business (as it was, well, his business) once described our current financial system as having organically and piecemeal emerged bit by bit into a rat's nest of tangled protocols. And that now it's ended up as a Gordian knot strangling us to death, but that cutting will kill us.

I don't believe the current system (by that, I just mean the institutions controlling currency) is what's killing us. The economic policies of different governments are the ones killing us.

I am a strong believer in leftist policies. However, I also believe that we don't have a better system than markets. The presence of markets requires the presence of Keynesian economics if we want to avoid boom-bust cycles.

That being said, do I think Keynesian economics will continue to exist decades in the future? No. One of the biggest flaws of this system is that monetary policies require a lot of time to have an effect on the economy. This huge ping difference understandably introduces many issues.

There are better ways to control the amount of money in circulation (like fluctuating transaction fees) whose effects can be a lot more immediate. However, they require all money to be electronic.

Immediate impact is not necessarily a good thing. A lot of our economy is built on predictability. Imagine going to use your credit card, and something costs more because the fee jumped yesterday, and might be less tomorrow. Banks would build in bigger fees to avoid the uncertainty. Because people want certainty.

Changes in transaction fees wouldn't be so drastic though. As you can make tens of thousands of corrections per year (compared to a couple in the current system), changes wouldn't affect you so much.

Isn't that achievable by VAT? No need for electronic money.

No. VAT is what you would consider to be fiscal policy. It would be a tax that the government imposes on you. The transaction fees would be money that ends up in the government's coffers, which the government would put to use somewhere. Increasing/decreasing VAT wouldn't decrease/increase the amount of money in circulation. It would just increase/decrease the amount of money that is in the government's control.

The transaction fees that I'm proposing here would be monetary policy. There would be huge tanks of money that noone uses. They would be filled up/emptied depending upon how above/below the current amount of money in circulation is from the target.

More money in circulation? Transaction fees increase, more money gets pulled out from circulation and gets put in the tank. Less money in circulation? Transaction fees get lowered (mostly negative) to get money from the tank into the economy.

This is possible only using an online only currency with a predefined algorithm controlling the transaction fees.

Doing this with hybrid currency (like we have now) would be an absolute bureaucratic nightmare. Imagine having to pay 1.00023 dollars every time you get a bag of chips. Imagine being a business where you have to manually input, document and pay the daily changing VAT to the government. The current system of changing interest rates for the federal reserve funds reserves this tedious calculation to the banks instead of all businesses.

Isn't it possible with a VAT-like system, where a collecting agency returns the collected money to the central bank?

This actually doesn't seem too bad. Most points of sale are digital.

Instead of changing it daily, only change it monthly/quarterly/... when the accumulated change is large enough to make a one dollar change on a 100dollar purchase? Isn't the decision to change the interest fork currently only made after gathering macro-economic indicators anyways?

I understand that insantly changing the transaction cost has an even faster reaction. But monthly might be good enough?

Yes, but it would be much more impractical compared to the existing interest rate system, where all the central bank has to do is change the interest rate. What about businesses that sneakily avoid this changing VAT tax? You would need a much stronger tax collection system for this. There are just too many problems associated with this, when compared to the current interest rate system.

What about small businesses operated by old people who aren't well versed with tech? What about furry artists who are getting like 5 dollars for their art? Do they have to incorporate a point of sale system now? Also, another huge disadvantage of a hybrid currency is the inability to calculate the amount of money being actively exchanged at a given unit of time. If all currency were online, you would be able to calculate exactly how much money was exchanged this minute.

Well that's how the current system already works. The central banks are constantly reviewing the economy to make these decisions. It's just that after a decision is made, it takes a lot of time for its effect to actually show in the economy (banks review the central bank's rates, change their own rates, people take more/less loans, deposit the money in some account, money multiplier effect happens accordingly and the amount of money actively being exchanged changes and so on).

The point is, for such long gaps, the current interest rates system just is a lot more practical. However, again, the big ping difference means that economic issues can go unaddressed for longer, causing more damage.

If we had an online only currency, we would have a crazily efficient system where the boom bust cycle for the valuation of our currency would be a lot more muted. However, with hybrid currency, the most efficient way is the interest rate method that we currently use.