this post was submitted on 14 Jan 2024

657 points (98.2% liked)

People Twitter

5230 readers

475 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a tweet or similar

- No bullying or international politcs

- Be excellent to each other.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

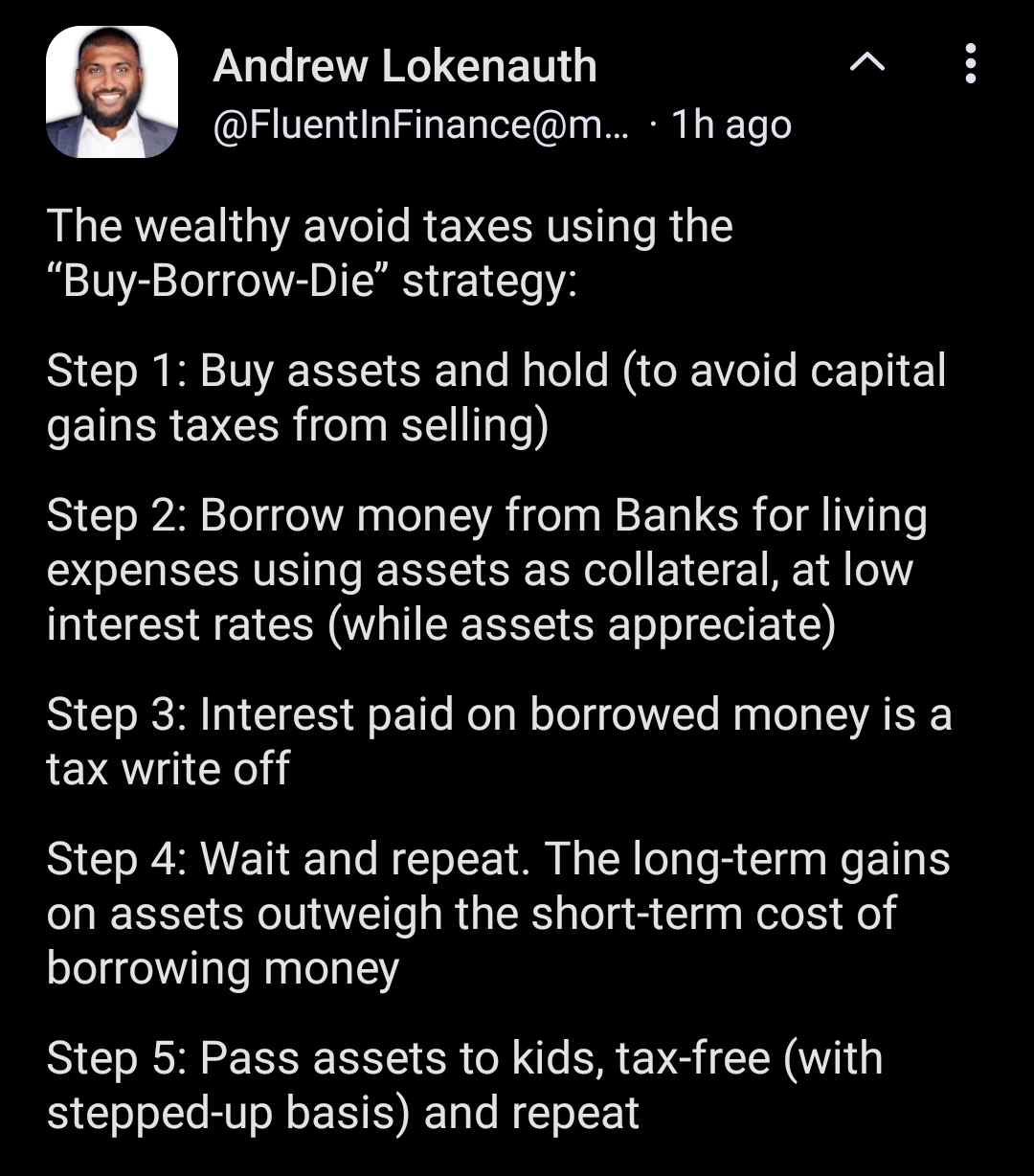

Loans are not taxable income is something that got left out. So you take out loans at interest rates lower than taxes. But yeah, this is all correct. We got offered a ridiculously low rate loan against our retirement funds, might as well have been zero, with no due date. Just a constantly revolving line of credit. Didn’t take it.

Why not?

Because it was tied to the stocks they wanted you to invest in. As long as the stock was up, you could borrow up to the amount the stock was worth. However, if you borrowed say 60% of the value, and the stock tanked 60% you immediately owed the 20%. It was in the lead-up to COVID, so we didn’t bite thinking things were gonna be really volatile.

Dodged a pretty serious one. Holy damn.

Yeah, sorta…. The responsible thing would be to not take out more than you can afford to pay back quickly, and if we were well off with good cash reserves then this sort of scheme would work out great. You would get a super cheap loan and skip out on a lot of tax. However, we’re pretty average and like most people don’t have cash laying around at all, so this seemed like a risky prospect. It wasn’t for us. But you can see that for a wealthy person this would work pretty well.