this post was submitted on 11 Feb 2024

265 points (98.2% liked)

InsanePeopleFacebook

2635 readers

3 users here now

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

That's altering a contract. If there's a dispute about added terms (that both parties signed) it's usually construed against the more sophisticated party, i.e. the bank, not the customer.

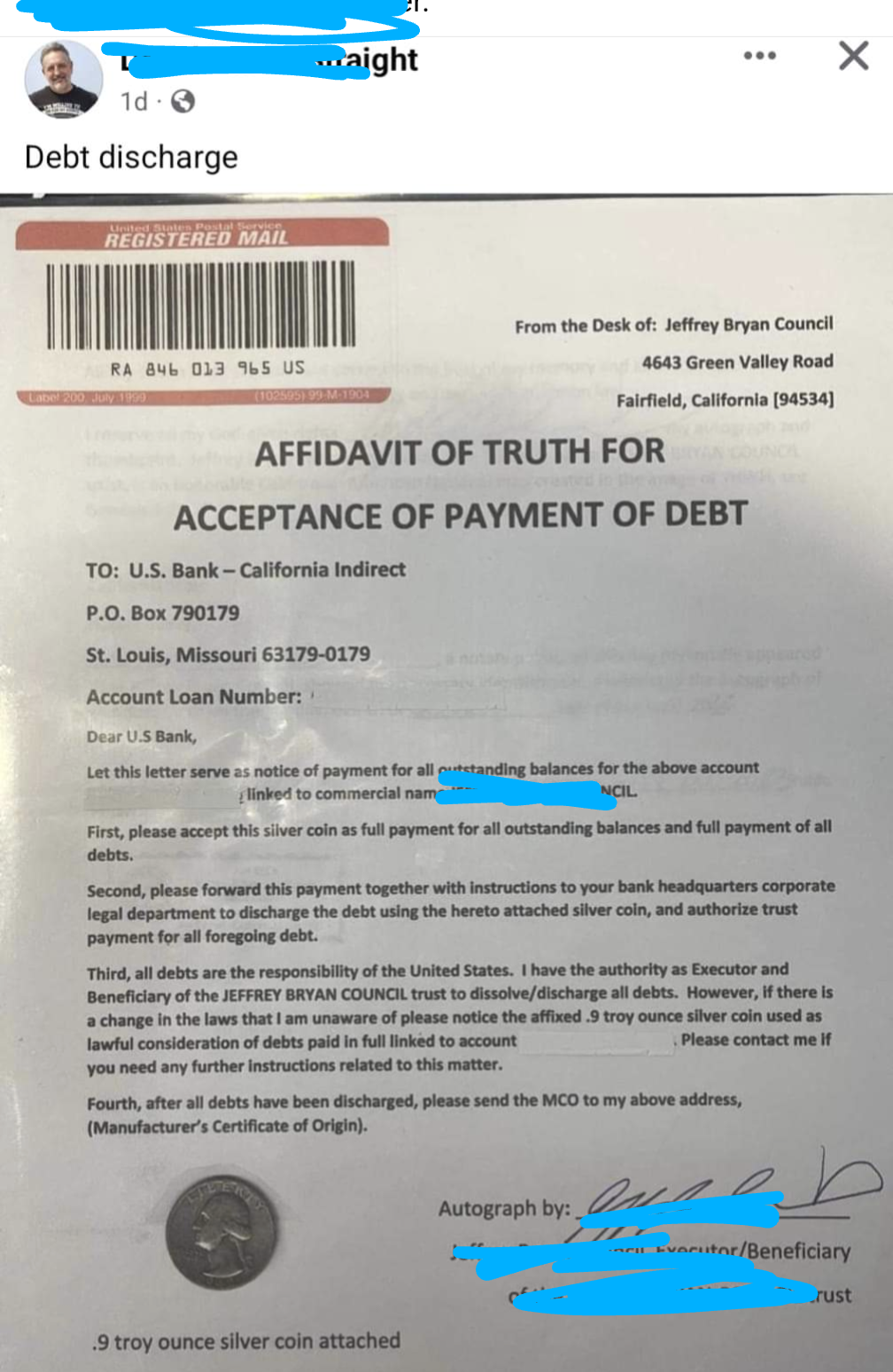

What this dude is trying to do is from the UCC chapter 3 on negotiable instruments, which are checks and drafts. What most people know as checks are called drafts.

Accord and satisfaction: it's funny, because is one of the rare times in law when the magic words have to be exact, and the phrase is "tendered in full satisfaction" or in full satisfaction. If the check says that in the memo line (if check is to you) or under an endorsement (if it was signed over to you), and you cash it after, you have liquidated the debt subject to certain limitations; i.e., if the organization tenders repayment back to you, the underlying promissory obligation is unpaused.

https://www.law.cornell.edu/ucc/3/3-311

Usually a draft have to be a naked order, directed to your bank, to pay the bearer or assignee, and nothing more. But this is one of the few exceptions to what you can write on a check and have the check still be valid.