this post was submitted on 14 Sep 2024

1641 points (99.0% liked)

Technology

69449 readers

4135 users here now

This is a most excellent place for technology news and articles.

Our Rules

- Follow the lemmy.world rules.

- Only tech related news or articles.

- Be excellent to each other!

- Mod approved content bots can post up to 10 articles per day.

- Threads asking for personal tech support may be deleted.

- Politics threads may be removed.

- No memes allowed as posts, OK to post as comments.

- Only approved bots from the list below, this includes using AI responses and summaries. To ask if your bot can be added please contact a mod.

- Check for duplicates before posting, duplicates may be removed

- Accounts 7 days and younger will have their posts automatically removed.

Approved Bots

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

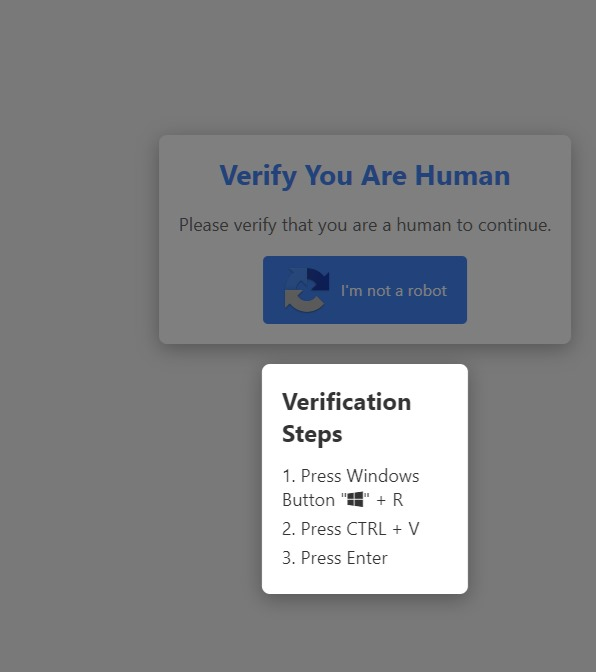

Pro-tip: Whenever you receive a call/text/email from "your bank" saying something is wrong, don't interact!

Open their app/website or call them yourself to verify.

I've gotten legitimate calls and texts from my bank about fraud (Citi and Capital One in the last year or so), and it's usually a quick 5-min discussion (yes that was me, no that wasn't me, etc). They usually ask for confirmation of identity at the start of the call, so that wasn't out of the ordinary.

What I usually do is go to my computer and login to my bank to check transaction history, so I can verify what they're saying. However, I was out of town and wouldn't be back in town for a couple weeks, and it was a new phone so I hadn't set up the app yet. Even so, there were some red flags I should have noticed, but didn't (probably due to being somewhat exhausted from traveling the entire previous day):

Also, I usually just ignore numbers I don't recognize, which would have prevented the whole thing as well, but this was a new phone and I hadn't yet transferred everything, so I didn't want to miss something important.

I usually practice pretty good security, but I didn't notice until halfway through the call. However, at least I did notice and was able to prevent any actual harm.