this post was submitted on 11 Jan 2024

1114 points (93.2% liked)

memes

14262 readers

3364 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

A collection of some classic Lemmy memes for your enjoyment

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

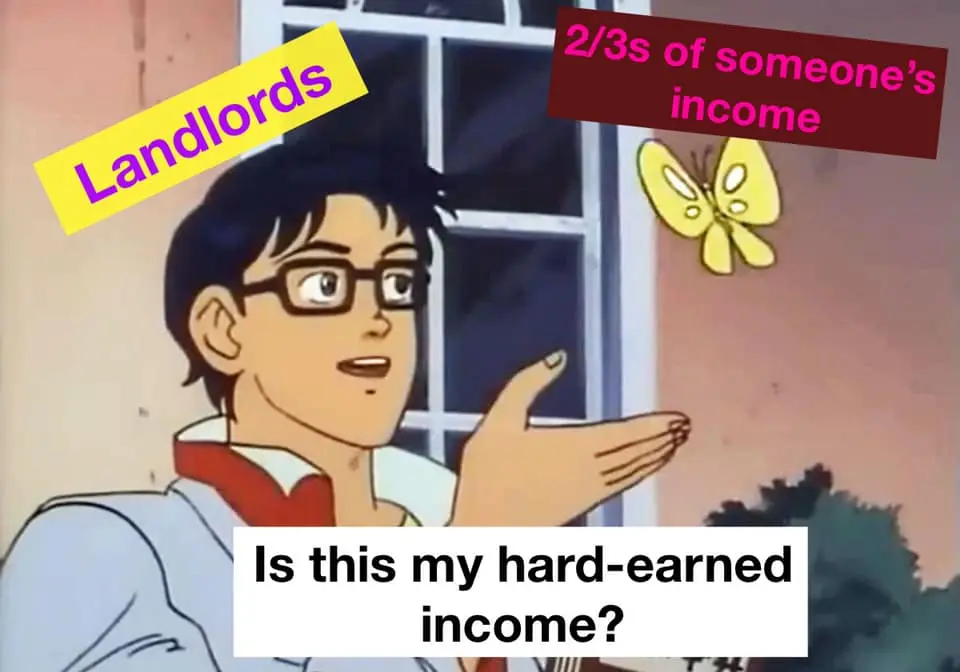

That's normal. The idea is you buy the house with a mortgage to then lease (let) out to tenants. The tenants then pay you rent equal to the mortgage plus a bit extra on top, which you use to pay the mortgage and make a profit.

Around here, it's not really linked. The heat of the apartment market is directly tied to the projected ROI, based on the demand of rental properties and the demand of rent itself. Like Bitcoin mining, sometimes the ROI gets really low or even negative in the short- or medium-term. The friction between the two factors tend to warm or cool one of the markets, but it takes times.

Consider/remember this. Many landlords aren't paying a mortgage, and don't need to tie rent to "a house's value at the time of purchase". They still profit when rent is below the average mortgage, or if rent is well above it. The only thing they care about is maximizing profits regardless of how full/empty their units are. Similarly on the renting side is lifestyle renters. They don't rent "because I can't afford a mortgage". They rent because they don't want to be tied down. They aren't ready to settle and might or might not move 1000 miles next year.

Those two categories are fairly numerous, and both present forces that influence the rental market independently from the purchase market. It means that places with less long-term demand like Detroit, Philly, or Houston have ownership TCO far lower than rent rates. Flip-side, there are just as many cities on the other side of the spectrum. The average rent in Austin is $2000/mo cheaper than mortgage payments on a starter home. In San Francisco, that difference is almost $3000/mo.

The rent is rent. It doesn't have to cover the mortgage all the time. It's not like someone rent is locked in for 30 years. And some bigger businesses will take the hit knowing the appreciation of the house will catch up or know they will buy a majority of the houses in the area and then raise rent that way to eventually be higher than the mortgage.