this post was submitted on 22 Apr 2024

193 points (95.7% liked)

Political Memes

8330 readers

1768 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

No AI generated content.

Content posted must not be created by AI with the intent to mimic the style of existing images

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

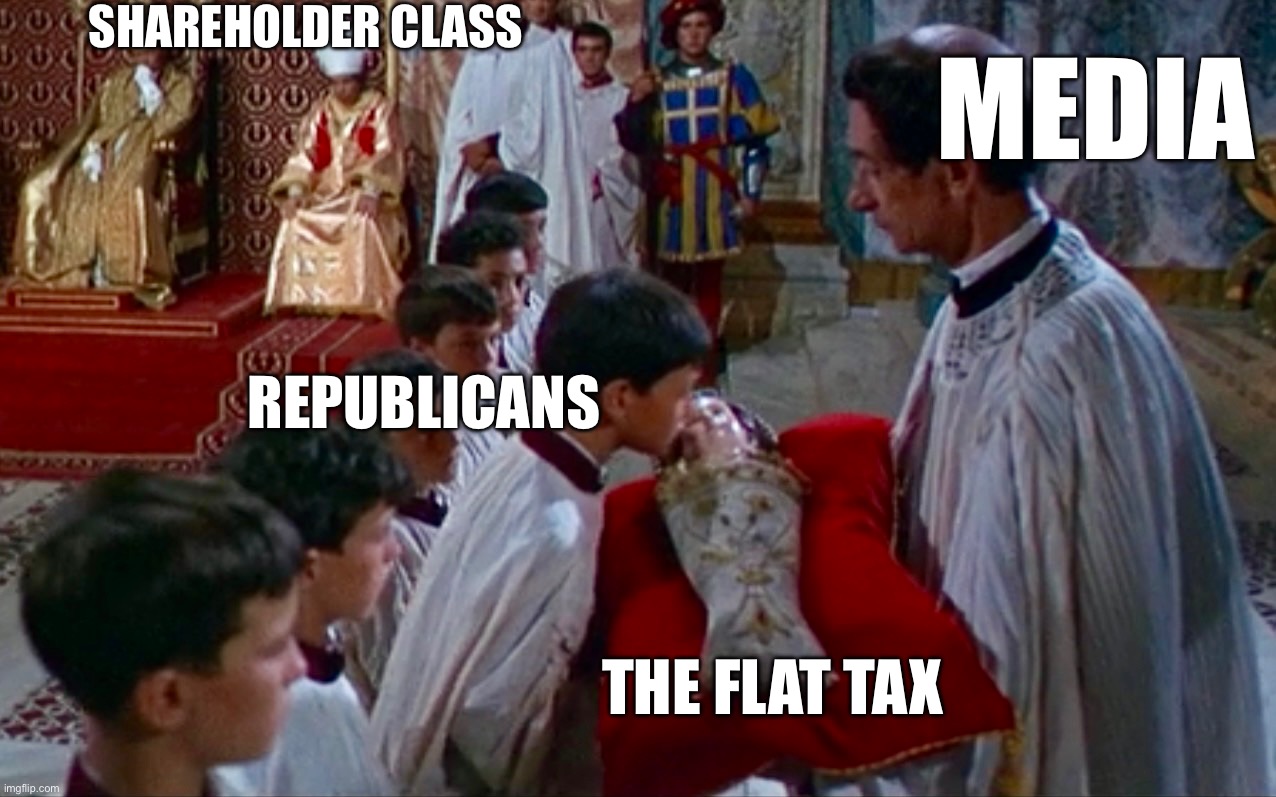

If it helps, don't think of our current system as a progressive tax, but think of it as a flat tax with discounts for being poor. The less you make, the higher the discount. Because 10% is not nearly enough money to pay for everything we need.

Rent, food, transportation, utilities, education, these are fixed costs that don't scale linearly with income. You might spend more on fresh vegetables or rent a nicer place if you have the money, but generally speaking the first $50k of anyone's income is going towards just existing. If you make less than that in the United States, you need every penny, and you probably need government services to help you survive. A flat 10% tax would probably kill you.

It's in (almost) everyone's best interest that nobody is struggling to survive. Social services help everyone at rates exponential to what they cost.

If you make $100k, congratulations, you can probably afford a starter house in some parts of the country. You might be able to save up for a vacation. You can begin to think about having kids (oh shit, did you already have kids? Because they're expensive as shit). You can afford a 10% tax with good budgeting.

If you make $500k per year, congratulations, you're wealthy. You can afford the American Dream of a house, a family, a dog, a yard, a car, and a retirement account all at the same time. You can also afford to pay far more than 10% without impacting your ability to pay for all those things.

The more you make, the smaller percentage of money you need. The higher you go, the worse it is for everyone if you simply keep all of your income. If you're making $10 million every year, you could pay 80% taxes and still have four times as much as the wealthy person described above.

High concentrations of wealth are bad for society. Coincidentally, the uber wealthy are the only ones that benefit from the suffering of poor people. As consumers and/or employees, people are easier to exploit when they are desperate, and everyone who amasses wealth is exploiting someone.