this post was submitted on 22 Apr 2024

1033 points (81.3% liked)

A Boring Dystopia

12665 readers

847 users here now

Pictures, Videos, Articles showing just how boring it is to live in a dystopic society, or with signs of a dystopic society.

Rules (Subject to Change)

--Be a Decent Human Being

--Posting news articles: include the source name and exact title from article in your post title

--If a picture is just a screenshot of an article, link the article

--If a video's content isn't clear from title, write a short summary so people know what it's about.

--Posts must have something to do with the topic

--Zero tolerance for Racism/Sexism/Ableism/etc.

--No NSFW content

--Abide by the rules of lemmy.world

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

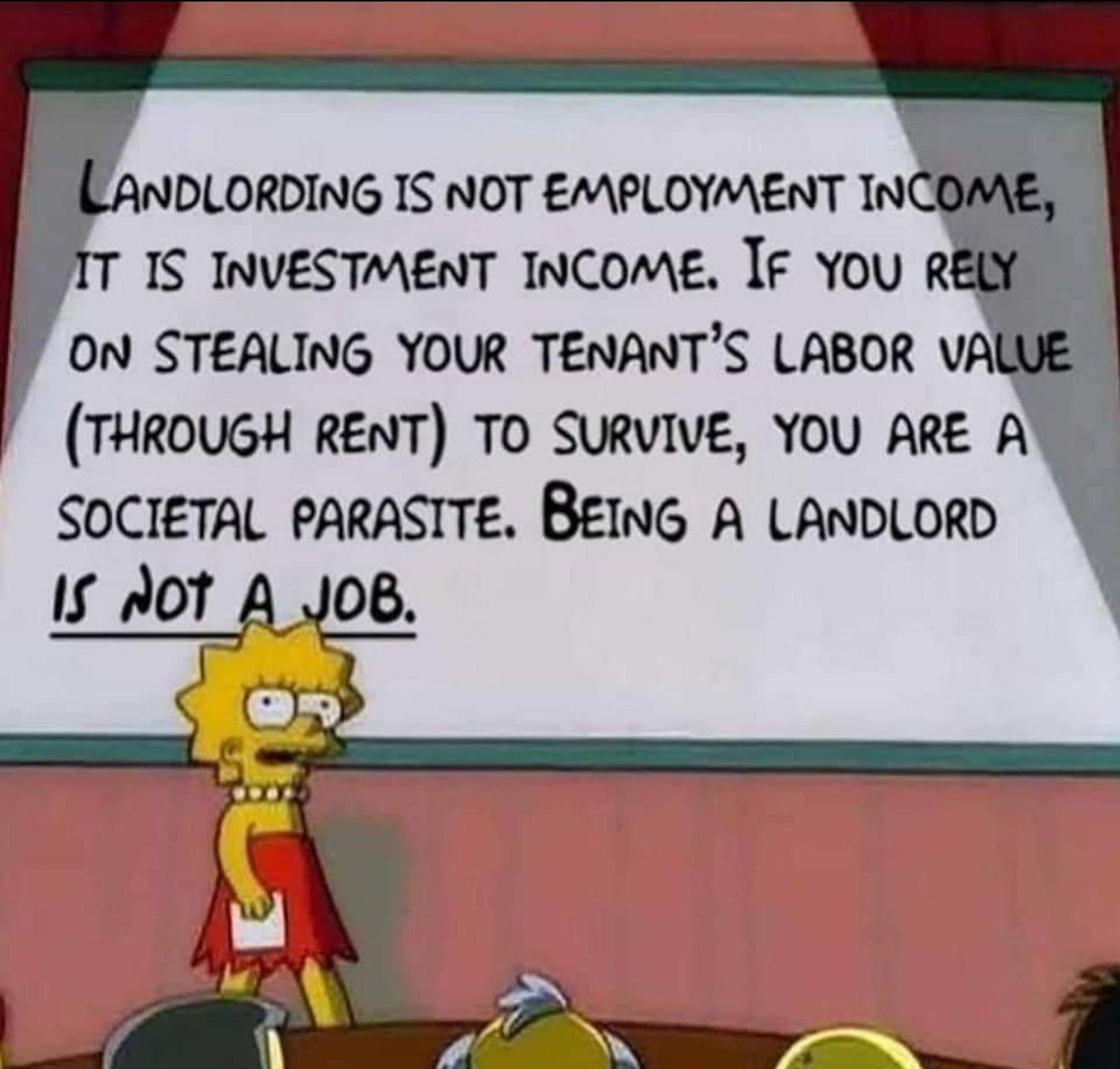

Yes, I'm familiar with the term. But we're not talking about economic rent, we're talking about landlording, which only overlaps in the terminology used.

Apartment rents and economic rents are two very different things. Economic rent is extracting value beyond the work needed to maintain the thing, whereas an apartment rent includes payment for the work needed to keep the property in good working order.

In some areas, rent is exorbitant, but I'm many areas it's quite competitive. I've evaluated buying a rental in my area, and the profit margins are too slim for the amount of work needed that I choose to invest my money elsewhere. Many seem content with breaking even for some reason and profiting mostly from property valuations increasing.

No shit. Equity is valuable. You don't even need property values to increase. You know eventually you pay off the house, right?

I'm saying even counting that. I'm not talking purely about cash flow, but long term profitability. In looking at properties and local rents, I'm seeing something like a 5-7% growth/year amortized over >10 years after all expected expenses and whatnot, which is quite a bit worse than expected returns in more passive investments like broad market stock index funds.

Granted, I haven't done the math for a few years so things may have changed, but at least at the time I was looking, a lot of smaller rental real estate investors didn't seem to understand how to properly value a property and just yolo'd it. It can make sense with higher volume because the cost per door goes down, but I'm talking about small-time investors with like 1-2 properties and no plans to expand.

Personally, if I'm going to buy a rental, I expect to make more than stocks since I'm taking on extra risk and work. The numbers just haven't looked good in my local area, especially given the higher insurance and borrowing rates for investment properties.

That said, I'm considering it if we move from my house because the lower interest rate makes it attractive (I'm in a sub-4% loan, which should be less than appreciation) and my wife is interested in a part-time job managing a property. Even so, we'd probably still be better off just selling and investing in stocks.

A house is a much safer asset than the S&P. Generally if you have enough wealth you have a mix.

Not necessarily, it's subject to a lot more geographic risk. If you have a properly diversified real estate portfolio (i.e. properties in a variety of geographic locations), sure, it can be less risky, but at that point you're so rich that even wild variation in returns isn't going to impact your retirement.

Your average landlord holding a small basket of priorities likely hasn't properly diversified. It's akin to buying a handful of blue chips, you're trading returns for consistency, but even blue chips fail (see GE) and sectors collapse. So if you're buying properties near you and your local economy tanks, you're kinda screwed. If you diversify, your maintenance overhead will jump and your margins will fall.

There's certainly money to be made, but for real estate it's usually at scale, and I'm not going to have enough money to make scaling realistic (nor do I want that much money anyway).