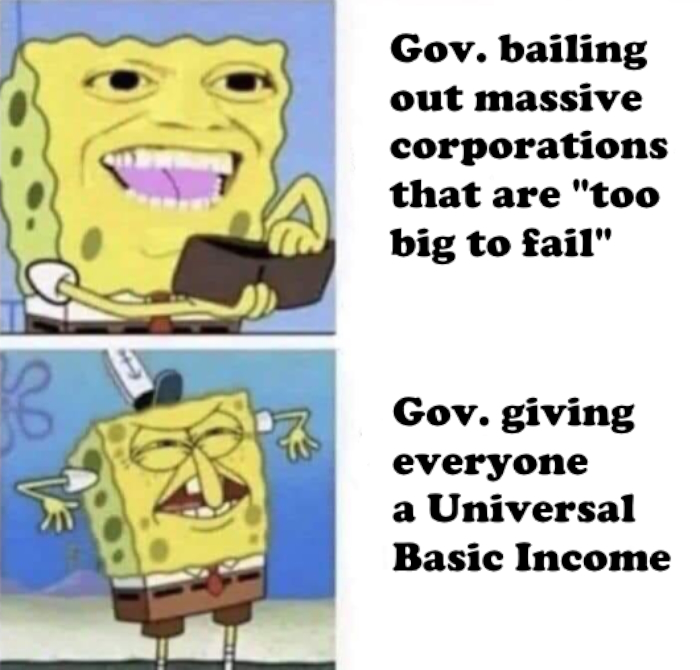

Yeah, gonna agree with this one 100%. That shit's dumb.

memes

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

A collection of some classic Lemmy memes for your enjoyment

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

Although I like the concept, I just don't see a world where UBI does anything helpful. Unless people are able to just not work and all goods are human free/automated. Otherwise companies' products and housing will rise to meet what they now know you have in income. Give everyone $1k and prices will rise to consume that $1k so you just end up feeding tax dollars into companies mouths. Pay for it by taxing the companies and they will increase prices till they hit the sweet spot intersection of cost/value, but people will still be at a negative because some of that resource pool gets eaten by government management of the UBI system.

May as well do what we used to and tax companies more and put that into social services, at least companies can't squeeze that from us.

If governments had paid to cover mortgages instead of just hand outs to major corporations the GFC would not have been so bad.