this post was submitted on 02 Dec 2024

984 points (98.6% liked)

memes

10665 readers

2287 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

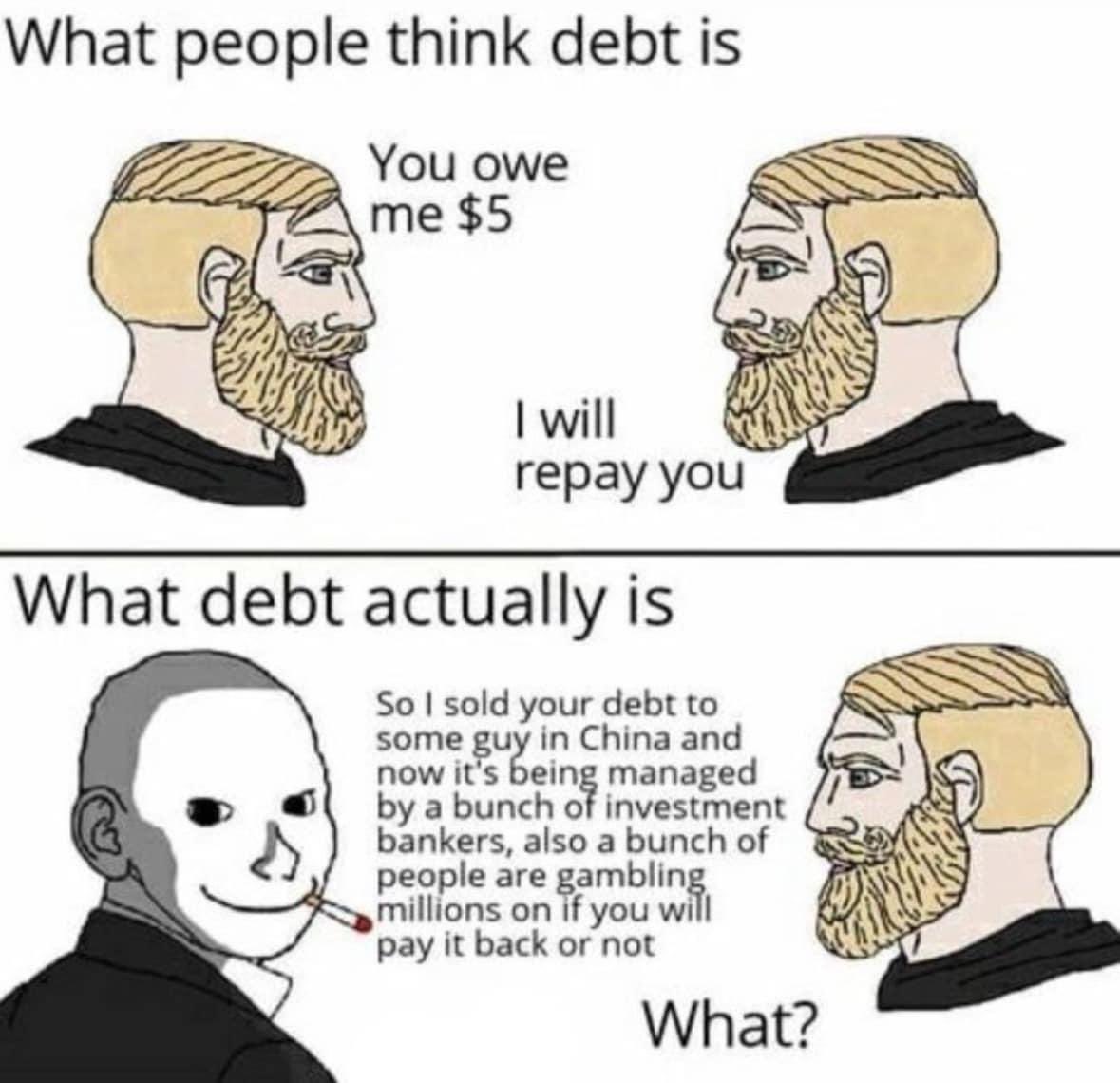

The derivatives market is out of control. The global annual GDP, actual goods and services produced, is something like $100 trillion. The derivatives market is something like 7 times that.

About 80% of the global economy is just gambling on what the other 20% will do.

A derivative != gambling what the other 20% will do.

A common derivative is a "future".

Pre-ordering a videogame is a future contract. It's a way for game publishers to finance the development of the game.

Sometimes futures are the only way to trade a product: all electricity is sold under a future contract. This refers to producers and consumers agreeing "tommorow 11am to 12am, I will consume (for the one party), and produce (for the producing party), 10MW of power". It is a simple necessity to trade electricity as a future contract, as electricity isn't easily stored, and the grid needs to be balanced (production ~= consumption) at all times. Here, the future contract is used as a method of coordination.

Futures are still technically gambling. In some cases a very, very safe gamble, but it still boils down to promising a predetermined price for a future transaction. There's always a chance that the underlying asset radically changes in value between the contract and execution dates.

I don't deny that derivatives are certainly financial instruments with valuable use cases. I'm just saying the scope of that market is out of control, especially in regards to financial derivatives. The MBS market basically directly lead to the '08 crisis, as you certainly know.

If you enter into a futures contract to fix your costs (electricity, oil, steel etc.) then you are reducing your risk. This is the opposite of gambling.

Sometimes doing nothing is the risky option.

Every transaction has a counter-party. Reduced risk on one side increases risk on the other.

Not necessarily. Two companies in different countries can both reduce their risk by entering into an FX swap.

I didn't know enough about FX swaps to comment personally, but Investopedia says this:

Company A sells widgets for dollars made from raw materials bought in yen.

Company B sells woggles for yen made from raw materials bought in dollars.

Both companies can reduce their risk by agreeing to exchange yen for dollars at an agreed fixed value. No one is gambling. Everyone is reducing their risk.

Interest rates, some companies may have floating income they wish to swap for long term fixed, and others may have too much long term debt which has a volatile mtm value.

Counterparty risk, usually mitigated by diversification. Companies pool their specific risk for a lower, but more certain, general risk (and use clearing houses).

Liquidity risk. Only a problem if you need to sell something quickly. Here there are gamblers taking advantage. There's no-one that naturally wants to take the other side of illiquid assets.

In isolation. But let’s look at insurance, to the consumer it’s the opposite of gambling. Gambling is seeking excitement through financial risk, but insurance is accepting that all of life is risky and that you’d rather pay a flat rate every month not to bother with the risk. But to the insurance company it’s not like they’re just holding and waiting, no they’re firstly pooling enough people to attempt to make payouts as stable as possible. Your house burning down is one of the worst days of your life, but it’s just another day at work to the fire department and insurance company, they see that sort of thing regularly. Additionally they hire actuaries and statisticians to minimize their risks and to make sure they aren’t charging people little enough they go under if they have a bad week or month. It’s why you can’t buy house insurance in Florida anymore, they’ve accepted that climate change has resulted in too much volatility in that area and that they wouldn’t be able to get people to pay the cost necessary to sufficiently hold that risk.

Firstly, insurance isn't a derivative, so it's not really relevant here.

Secondly, paying insurance is still a form of financial risk. If you pay insurance for the entire time you own a home, but never file a claim, then that's basically just money wasted. You're trading material risk to your home for financial risk.

And it's also basically a gamble. You're betting that the total you pay in premiums will be less than whatever the insurance company will pay you. The insurance company is betting that it'll be higher.

Sure, I agree. But in the same technicallity; purchasing or selling anything is technically gambling, there's a chance that it will devalue or increase in value over time. You could've bought (or sold) earlier (or later). (Electricity market, again, being an interesting exception, as the product is destroyed as soon as it's created. One could say the true value is never discovered, as it's only sold as futures).

The fundamental problem that lead to the '08 crisis was incorrectly priced mortgages, and risk of repayment/devaluation. Even if the morgages were held by the original issuers, the same outcome would've occured.

It wasn't the derivative market that was the problem.

An example of a derivative, that I can't think of any reason for existing, other than increasing risk, are leveraged ETPs. I'd call those as close to pure gambling of any derivatives I know of.

Those mortgages were priced incorrectly because the derivatives market inflated their value. There were other factors that contributed certainly. The credit rating agencies certainly played a critical role, but they were incentivized to inflate their rating because of the MBS market.

The regulation of these markets was also to blame, and that's a whole other can of beans, but again this was due mostly to the revolving door between the regulatory agencies and the investment funds that profit from lax regulation of the derivatives market.

shouldn't gambling be defined as a strictly asset lacking market environment? Meaning there is no actual value within the trading being done, and the fact that it is purely and entirely speculative on nothing other than "optimal odds"

Where as the market in question would be defined more accurately as a potentially unstable (as all markets are, welcome to capitalism) commodity trading marketplace.

Gambles on failure of stocks shouldn't be allowed, regulate wall street WS. They will make off like bandits when the tariffs hit.

well then you would be a very bad investor to not jump in on the market hype, assuming your statement is right and that everything will implode.

I disagree. That's like saying insurance shouldn't be allowed.

Highly regulated would be anotheratter though.

Nah wall street as it is should absolutely not be allowed, frankly speaking I think stocks should be locked down to regions not just countries. Also regulations are good. I will note that I am generally against the concept of large regional corporations let alone multinational ones, so that side of things is certainly effecting my opinion. Also logistics and trade companies are the exception even if I wiould replace them all with Teamster syndicates.

The notional value is that size, but that's not really representative. You can't compare or even add notional amounts.

For example, temperature derivatives would have a notional value measured in millions of °C.

Well put

Holy crap some source on these numbers? Not doubting them just want to read more about it.

It was what popped up with a quick search. It's a difficult thing to accurately calculate, but estimates of the total derivatives market can be up to $1 quadrillion. Again, there are difficulties measuring and calculating this, but it's absolutely massive by any measure.