this post was submitted on 11 Jan 2024

1114 points (93.2% liked)

memes

16552 readers

2925 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

A collection of some classic Lemmy memes for your enjoyment

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

I never understood this sentiment. For single family homes the market sets the price. It's not like when you buy a house and use it for a rental all of sudden it's cheaper or more expensive in some way. You could make a price/demand argument but then again the underlying demand is housing not money hungry landlords. If there was not an underlying housing demand, no one would rent and it would fail as an investment.

How does the community serve those who want to rent? Apartments? Now that is where we can agree. Apartment valuation is calculated on operations not on the market. The only way to raise value of an apartment is to raise rent (or reduce expenses in some way but at some point you can only do so much). At least with SFH you have appreciation that landlords can factor in for return.

Lastly, 2 of my rentals were foreclosures. If anything I'm performing the city a service by buying these properties and adding value. If you had to choose, would you rather live next to a vacant house or a rental?

To answer your question, it's fair for a renter to not build equity because they don't pay for upkeep or have the risk associated with the loan. You have to put skin in the game at some point.

Edit: there are some good points for the other side of the argument if you keep reading. I don't know what the answer is but I'm not convinced that restrictions or to disincentivize rental operations is the answer.

Close. You're right there's no profit without demand. Now, consider what happens when certain entities with way more money than most of us comes along and decides they want to induce artificial scarcity by buying up and leaving empty a ton of houses.

They both kinda suck. I'd rather live next to someone who is invested in the property.

I could agree with this if rent was pegged to a percentage of the mortgage value. The issue is that the landlord makes a purchase and now owes, let's say, 1k/mo for everything. Rent, taxes, fees, etc.

They want to rent that place out, great. Maximum rent should be LESS THAN that 1k, because the landlord is already getting theirs, they're getting equity, and the only thing they have to do is upkeep they'd have to do regardless.

Apartment valuation in my area spiked until the ROI crossed 10+ years. People stopped buying apartment buildings for a while except as owner-occupied with renters to assist. But in my area, none of those reach anywhere near a net-zero mortgage. The market absolutely still has an effect on valuation in most areas.

But two towns over, people are selling apartment buildings with 2-3 year ROIs, and they're being swept up by one of a small handful of investors. Building maintenance is terrible, and there's very little interest in the legal risk of being slumlords except those who are already slumlords over 40-50 buildings or more.

I beleive housing should be a privately owned venture, at least for suburb housing where the entire plot is included. Outside of that social schemes should purchase/build properties for rental purposes.

Like you said, the housing market is in demand. But how much of that demand is manufactured by landlords purchasing more property to rent versus real buyers looking to buy-to-occupy?

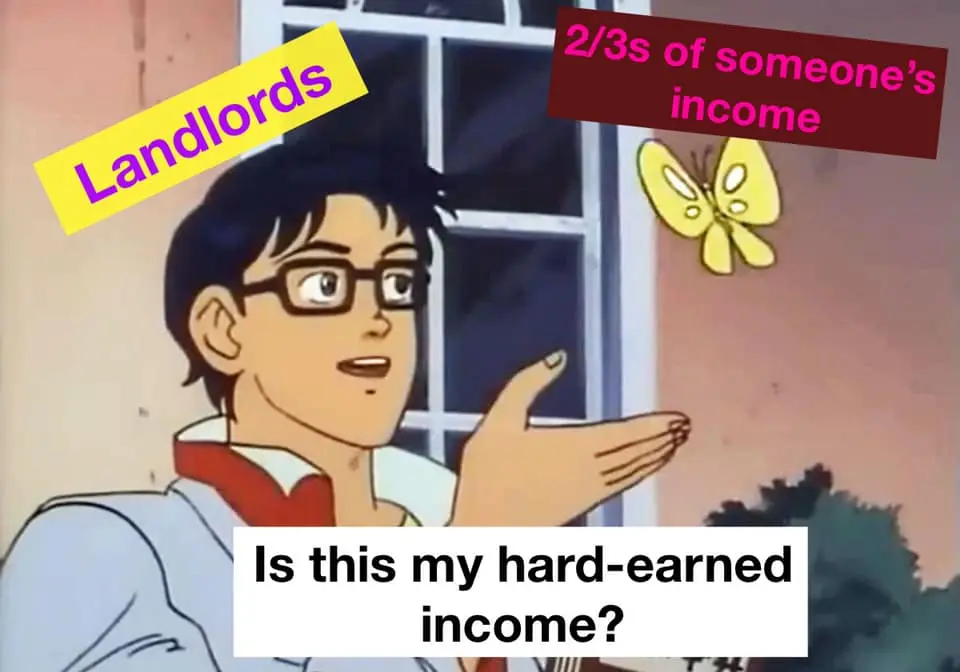

Your argument for cost of maintenance is part of the equation, however the rent costs should be the cost of maintenance and upkeep with a modest margin for investment. However that's not the case. Landlords want to take their cake and eat it. Rent is now the cost of the mortgage, AND maintenance/upkeep AND profit. Its a win for landlords and a lose for renters. If the renter is capable of paying the inflated rental costs on a regular, then they should be owning their own home. The current status-quo is unfair.

Just FYI, I am a home owner. I know the costs of mortgages, the risks that are involved and the maintenance costs of keeping a home running.