this post was submitted on 02 Dec 2024

984 points (98.6% liked)

memes

10665 readers

2287 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

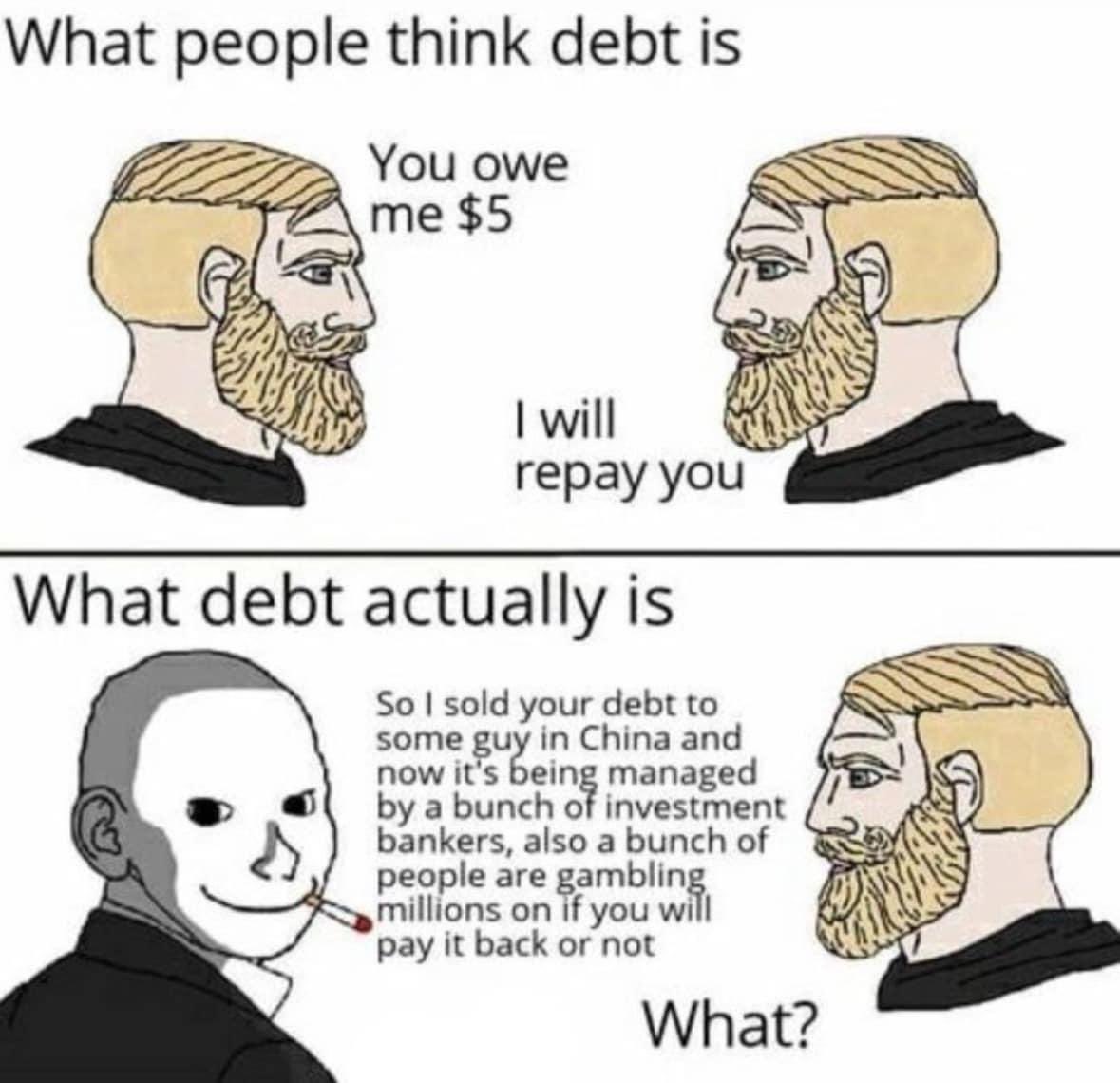

Man, if it were just this then banks would be pretty stable.

The problem is banks don't just lend and receive money, they invest. And they invest in everything. And they take super risky bets.

This is what caused the banking collapse of 2008 and what caused the death of SVB and a few other banks.

Your bank doesn't just hold your money and debt, if you rent it almost certainly owns a peice of the company managing your property. It owns crypto assets. It has shares of startups. And it uses those assets to get more money to create more debt.

Dobb Frank was created to stop some of this, but unfortunately it's been effectively repealed already.

Yup, and banks are returning to high-risk securities, trading in debt-based products like collateralized loan obligations, just like they did leading up to the 2008 global financial crisis.

https://www.theguardian.com/business/2024/nov/24/remember-the-global-financial-crisis-well-high-risk-securities-are-back

Bank: You should take out this loan you can’t afford to repay. Don’t worry, we’ll make it seem like a great idea.

Unqualified borrower: Ok, since you made it seem like a great idea.

Bank: Great! Hey, other bank, betcha this guy won’t repay this loan.

And Dodd-Frank was passed as a weak facsimile of the previously-repealed Glass-Stegall act that was written after the Great Depression and effectively prevented any major financial collapses for 70 years.

1000%

Fractional reserve banking and the modern securities market is a trip. Kafka was on to something.