this post was submitted on 28 Dec 2023

173 points (85.3% liked)

memes

10322 readers

1656 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

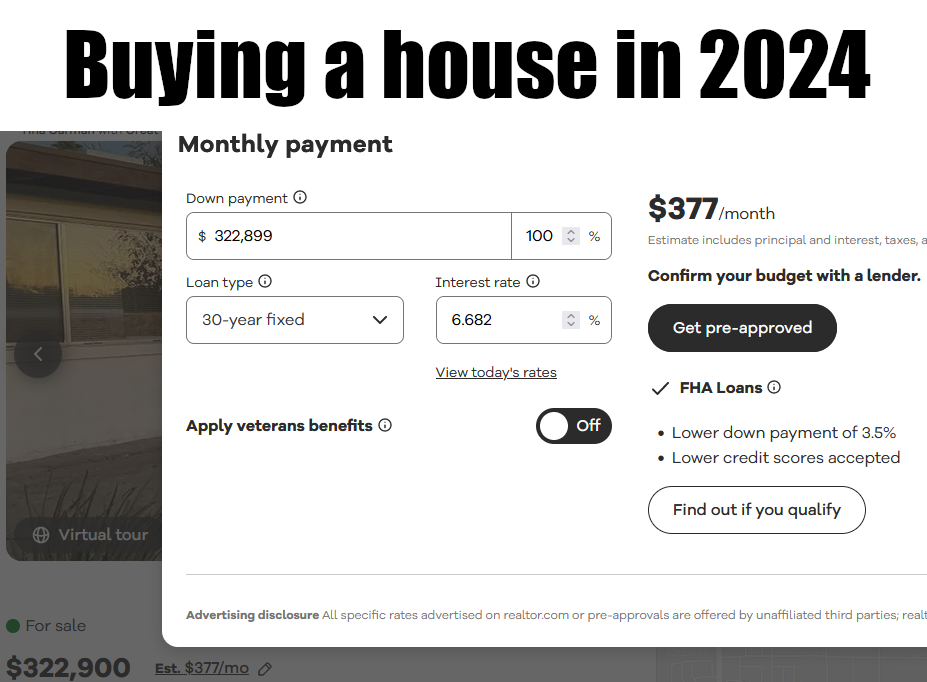

LOL please remind me again why financial experts advise against paying for a house in one lump sum?

p. s. interest rates are infuriating. imagine paying $377 a month for 30 years just to pay off that last dollar you left off at the beginning🤦♀️

Because if you have several hundred thousand dollars laying around to pay in cash, you’re better off investing that into an index fund which will have a higher rate of return than the interest on the mortgage.

If you have $500k and want to buy a $500k house, you could pay the entire $500k down and own the house free and clear, but you would only gain the appreciation on the house if you ever sell it. Assuming doubling in value every 10 years it should be worth $4M after 30 years.

If you had $500k and took out a mortgage of $400k, at the national average of 7% and 30 years, you would pay a total $1,033,654. If you took the other $400k you had and put it in just the S&P 500 which has averaged right at 10% annually, and left it there, you would end up with $6,979,760 in that fund at the end of the 30 years.

So you would come out ahead by about $4 million at the end if you took the mortgage and invested the cash.

Liquidity Risk: Paying in full ties up a large amount of capital in one asset, reducing financial flexibility and liquidity.

Opportunity Cost: The capital used for a lump sum payment could potentially yield higher returns if invested elsewhere. Although, at current rates that is probably unlikely.

Leverage: Mortgages allow for leverage, where you can control a large asset with a smaller initial investment.

Interest Rates: With historically low interest rates, financing can be more cost-effective than using cash. This is currently not true.

Diversification: Investing the money in a diversified portfolio can reduce risk compared to putting it all in a single property. See Leverage.

Tax Benefits: Mortgage interest payments can often be tax-deductible, which is not applicable when buying outright.

Okay but if you pay it all off in one lump sum there won't be any interest payments at all. So both scenarios kinda break even in that regard.

Ah, so it depends if you want to buy a house so you have somewhere safe to live that you can't be evicted from, or whether you want to use it to destroy society for your own immoral personal profit?

[Edit] Sorry, I'm probably being a bit severe there

Insurance and property taxes are factored into the monthly payment, though it's not obvious from the meme

Hm. I always assumed insurance is paid separately to the insurance company and property taxes are paid separately to the county.

If you have a mortgage, 99/100 the bank is going to make you pay into escrow for insurance and taxes.

This is just a simple online mortgage calculator so it’s not factoring in that you could just pay those yourself if you’re paying all cash for the house.

They can be or they can be paid through "escrow" and your mortgage servicer will pay them.

Usually sites like these want to show total monthly cost though, so they tend to include estimates for property taxes and insurance in the monthly payments. Whether it gets paid through your mortgage servicer or directly by you doesn't change much.

It can be paid directly by you, or it can be held "in escrow" and paid by your lender. Ultimately it doesn't make a difference financially, but it does mean logistically you either are paying one bill vs 3+.

It also comes at the risk that your lender fucking up could result in, best case scenario, a paperwork nightmare and maybe a small fee with your insurance/county/whatever, worst case scenario, the cancellation of a policy you may or may not be able to get back into easily.

Online calculators almost always include, or have an option to include, these costs. In part it's because that's the number the bank will use to determine what you qualify for. Makes it much easier to say, "here's your monthly obligation" and compare that to you monthly income, instead of "here's your monthly obligation, and here's your twice-a-year tax obligation."

The screenshot literally says that the payment is including property taxes and insurance.