this post was submitted on 28 Dec 2023

173 points (85.3% liked)

memes

17022 readers

4208 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads/AI Slop

No advertisements or spam. This is an instance rule and the only way to live. We also consider AI slop to be spam in this community and is subject to removal.

A collection of some classic Lemmy memes for your enjoyment

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

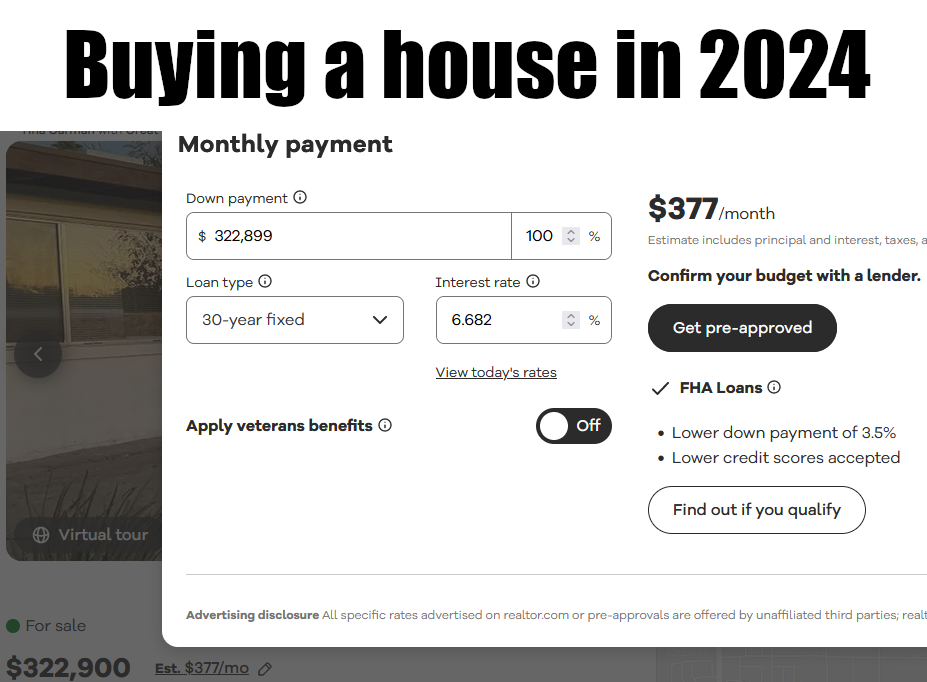

Because if you have several hundred thousand dollars laying around to pay in cash, you’re better off investing that into an index fund which will have a higher rate of return than the interest on the mortgage.

If you have $500k and want to buy a $500k house, you could pay the entire $500k down and own the house free and clear, but you would only gain the appreciation on the house if you ever sell it. Assuming doubling in value every 10 years it should be worth $4M after 30 years.

If you had $500k and took out a mortgage of $400k, at the national average of 7% and 30 years, you would pay a total $1,033,654. If you took the other $400k you had and put it in just the S&P 500 which has averaged right at 10% annually, and left it there, you would end up with $6,979,760 in that fund at the end of the 30 years.

So you would come out ahead by about $4 million at the end if you took the mortgage and invested the cash.