this post was submitted on 27 Apr 2024

720 points (96.3% liked)

Political Memes

5693 readers

1668 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

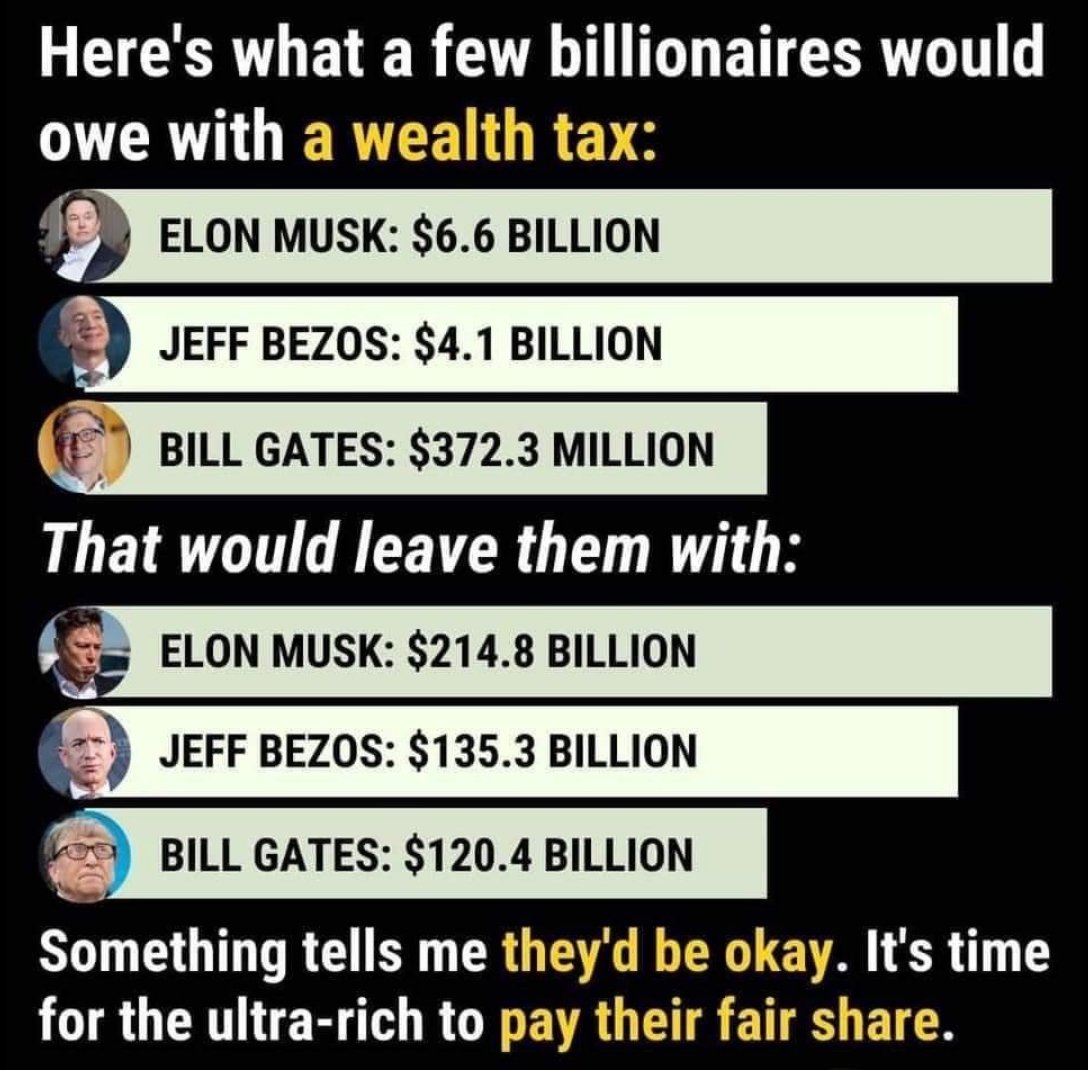

While I definitely agree with the approach, would it not make sense to also run a wealth tax alongside this, to ensure that assets aren't just stored outside of the US?

I'd be all for all of the below:

The problem with some of the listed names is that they don't own their companies. Bezos hasn't owned Amazon for 3-4 years now, and he's been dumping stock for years. If we only taxed against specific types of collateral, the rich would just move to something else.

Wouldn't a wealth tax increase risk of assets being stored and hidden outside the US?

Americans are already taxed on worldwide income. If there's a wealth tax and they tried to get around it by storing assets outside the US, wouldn't hiding it be much the same as attempting to hide non-US income?

Any comments on whether a wealth tax is even constitutional, since the 16th amendment only authorizes an income tax and not a wealth tax?

Do they get a deduction when they repay the loan on the back end, if they had to pick up income for the loan when it was received?

Wouldn't it be disruptive to cap executive pay during lean years, or startup years, or recession years etc? Wouldn't that create even more incentive than there already is to aggressively pump up income in order to meet arbitrary quarterly/annual earnings goals to keep executive comp high? What if there was a lot of income last year, little income this year, and a lot of income next year, etc. Should everyone's income seesaw up and down or could we maybe plan around cash flow a little bit?

"Yearly audits of accounts held by wealth management firms to ensure that no one is fiddling with the books" is such a loaded sentence full of ignorance and naivete I really can't begin to respond to it besides telling you that it instantly identifies you as someone who doesn't know wtf they're talking about and shouldn't be commenting on such things.

Finally, Bezos is still the executive chair of Amazon and still holds 990 million shares as of November 2023 so idk what you're talking about with that last sentence. Link to the SEC Form 4 Proxy Statement, a primary source document despite the shady url: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001018724/0978cda1-fd60-4d80-bdc4-e6911372e1a3.pdf or you can find it here dated November 1 2023: https://ir.aboutamazon.com/sec-filings/default.aspx