Lemmy Shitpost

Welcome to Lemmy Shitpost. Here you can shitpost to your hearts content.

Anything and everything goes. Memes, Jokes, Vents and Banter. Though we still have to comply with lemmy.world instance rules. So behave!

Rules:

1. Be Respectful

Refrain from using harmful language pertaining to a protected characteristic: e.g. race, gender, sexuality, disability or religion.

Refrain from being argumentative when responding or commenting to posts/replies. Personal attacks are not welcome here.

...

2. No Illegal Content

Content that violates the law. Any post/comment found to be in breach of common law will be removed and given to the authorities if required.

That means:

-No promoting violence/threats against any individuals

-No CSA content or Revenge Porn

-No sharing private/personal information (Doxxing)

...

3. No Spam

Posting the same post, no matter the intent is against the rules.

-If you have posted content, please refrain from re-posting said content within this community.

-Do not spam posts with intent to harass, annoy, bully, advertise, scam or harm this community.

-No posting Scams/Advertisements/Phishing Links/IP Grabbers

-No Bots, Bots will be banned from the community.

...

4. No Porn/Explicit

Content

-Do not post explicit content. Lemmy.World is not the instance for NSFW content.

-Do not post Gore or Shock Content.

...

5. No Enciting Harassment,

Brigading, Doxxing or Witch Hunts

-Do not Brigade other Communities

-No calls to action against other communities/users within Lemmy or outside of Lemmy.

-No Witch Hunts against users/communities.

-No content that harasses members within or outside of the community.

...

6. NSFW should be behind NSFW tags.

-Content that is NSFW should be behind NSFW tags.

-Content that might be distressing should be kept behind NSFW tags.

...

If you see content that is a breach of the rules, please flag and report the comment and a moderator will take action where they can.

Also check out:

Partnered Communities:

1.Memes

10.LinuxMemes (Linux themed memes)

Reach out to

All communities included on the sidebar are to be made in compliance with the instance rules. Striker

view the rest of the comments

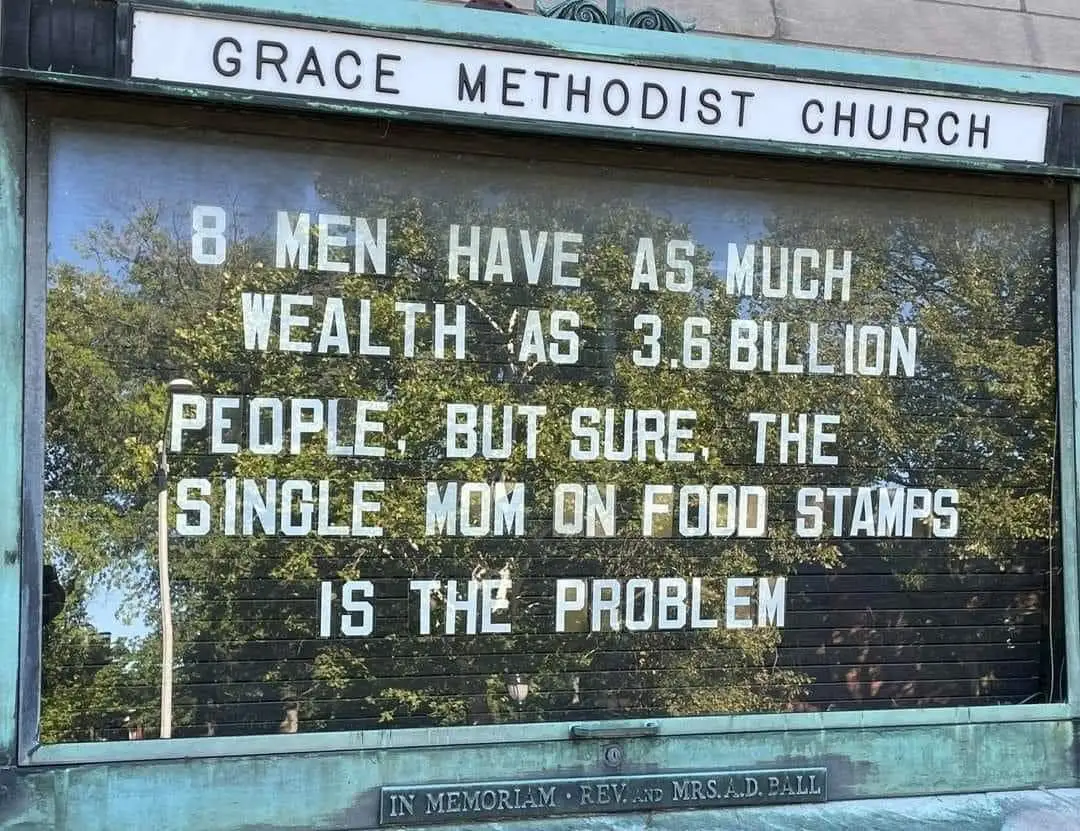

Since when does wealth be shared when someone dies ?

No, the money will go to their descendants who will try to get even richer than their parents. A large part of that money will also be taken by the state because ?? and ??.

Nothing would change.

to make society work, and IDK, give food stamps to the single mother? it's literally the theme of the post.

I want the same thing I just don't think taking what is inherited is the way to do it.

I would much rather see the ultra-rich pay properly their taxes when they are alive.

It's not like taking inheritance money is the only way to finance things. I don't see the reasoning.

I can totally understand why someone with huge revenue would pay more taxes but I don't see why someone who inherits has to pay taxes at that exact moment.

In any case, I think you are missing the point and answering the question "for what purpose?". Instead of "why?".

I want to know why it's more logical to pay taxes when you die rather than paying them in the first place when you got the revenue.

Obviously, the money collected is useful I just don't see why it has to be collected when it is a time of sorrow for a family.

~~Also where I live it's like 50% of the inheritance that is taxed. It is not just significant, it is 50% of the work of a life that goes in one shot to the state when someone dies.~~

Edit: I was mistaken, I did some calculations and a practical example: If I inherited 200 000€ I would have to pay around 18 194€ (20%)for one taxation and some additional applies but it's nowhere near what I was told. This rate goes from 5% to 45% for the largest inheritance. In reality, to get a 45% taxation in France I would have to inherit more than 1.5 million euros.

I still think this taxation is too high and I regret that my comment is not clear. I don't want less taxation overall I just think it makes more sense to take the money over time on the revenues. Anyway, taxation for inheritance is still something people here are very much concerned about. Parents want their children to inherit as much as possible of their wealth obviously so seeing a good chunk going to taxation is not great. Again I'm ok to pay taxes. But we have 192 different taxes here (that's the exact number calculated in 2014) so I would prefer a system where most of the taxation comes from revenues and what you own and that's it.

I'm curious where you live? Because many places have laws like that. Almost NO WHERE do the ultra rich actually pay that. There's always loop holes built in for them.

You're just not killing enough people. At some point the heirs decide to give it all away.

This has historical precedence. Many times over. Collective action works.

Shhh, some people want an imaginative excuse to kill others.

We could kill the descendants of the billionaires as well.

Your mistake is thinking that you are talking to people who think more than 2 feet in front of their noses.