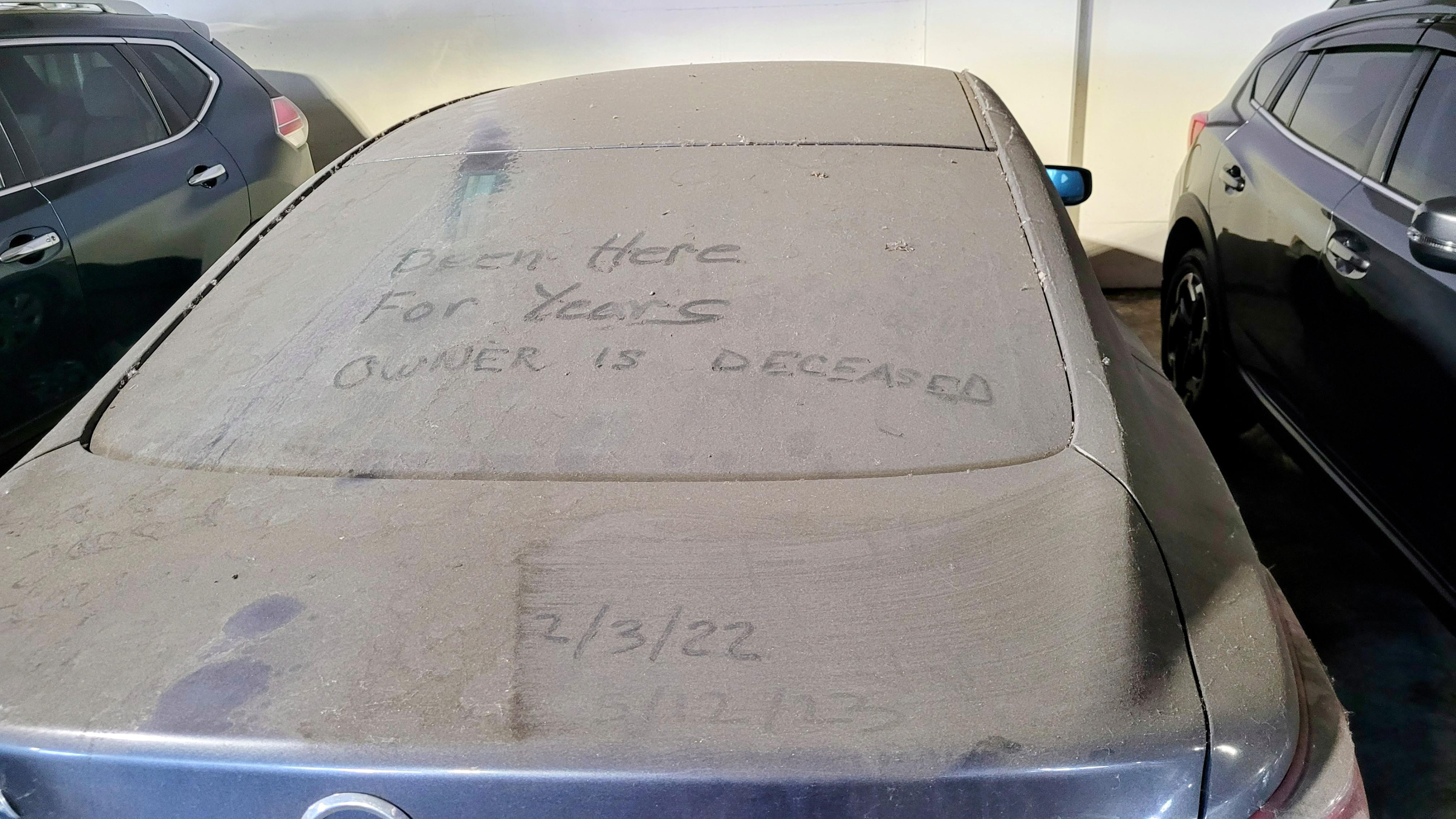

Thanks, I hate it

Google, Apple, and rest of big tech are pregnable despite their access to vast amounts of capital, and labor resources.

I used to be a big supporter of using their "social sign on" (or more generally speaking, single sign on) as a federated authentication mechanism. They have access to brilliant engineers thus naively thought - "well these companies are well funded, and security focused. What could go wrong having them handle a critical entry point for services?”

Well as this position continues to age poorly, many fucking aspects can go wrong!

- These authentication services owned by big tech are much more attractive to attack. Finding that one vulnerability in their massive attack vector is difficult but not impossible.

- If you use big tech to authenticate to services, you are now subject to the vague terms of service of big tech. Oh you forgot to pay Google store bill because card on file expired? Now your Google account is locked out and now lose access to hundreds of services that have no direct relation to Google/Apple

- Using third party auth mechanisms like Google often complicate the relationship between service provider and consumer. Support costs increase because when a 80 yr old forgot password or 2FA method to Google account. They will go to the service provider instead of Google to fix it. Then you spend inordinate amounts of time/resources trying to fix issue. These costs eventually passed on to customer in some form or another

Which is why my new position is for federated authentication protocols. Similar to how Lemmy and the fediverse work but for authentication and authorization.

Having your own IdP won’t fix the 3rd issue, but at least it will alleviate 1st and 2nd concerns

Zuckerberg always looks so uncomfortable. Is this what it looks like when you sell out the human race so you can continue to hoard wealth?

"how will I feel like men with big pee pee tho"

Could be worse. Could have been an incel camino

It’s just a little piss, bro. Stop being a bitch

What’s to stop Cali national guard from ignoring Orange man? Or maybe I have been watching/reading too much fiction.

Before settling in Foster City, California, in 1977, the Thiel family lived in South Africa and South West Africa (modern-day Namibia). Peter changed elementary schools seven times. He attended a German-language school in Swakopmund that required students to wear uniforms and utilized corporal punishment, such as striking students' hands with a ruler. He said this experience instilled a distaste for uniformity and regimentation later reflected in his support for individualism and libertarianism.[20][21] The German community in Swakopmund that Thiel grew up in was known at the time for its continued glorification of Nazism.[22][23]

Thiel and Muskrat cut from the same cloth of trustfund babies and apartheid benefactors, m8

Peter Thiel is one of the many money men that want to privatize everything, dismantle federal government, hand keys to "network states" (company towns but somehow worse).

Goal is none or self regulation. Maximize profits. They want to shape the world into this hyper capitalistic society and surveillance state. Palantir is just one of those companies in a massive portfolio to fulfill this stupid dream shared by many industrialists.

Depends if teleportation uses TCP or UDP

Probably fake story but it’s more likely to domesticate an opossum over a raccoon. Maybe story over the decades changed the animal because human story telling results in many fabrications and hallucination of details.

Adult raccoons are vicious and territorial cunts. Well at least the one I encountered anyways

Smells like corporate meddling.

Reminds me of the 60 Minutes and CBS controversy. In the mid-90s, producers worked on a segment to expose big tobacco knew about the dangers of nicotine yet sold products anyways.

Big tobacco laid down the pressure on 60 Minutes and CBS network. 60 Minutes was huge back then and had high levels of journalistic integrity. Ultimately, CBS executives killed/delayed/manipulated/watered down the big tobacco story. CBS was at the time was apparently in merger with Westinghouse and executives were pissing their pants the big tobacco lawsuit could kill that M&A.

ABC is owned by Walt Disney now. I think they have a few acquisitions lined up that they need green lit by Orange man administration. Wouldn’t be surprised if this is the case here.

Fire Moran to appease Orange man.

Honestly need to break up the big corporations.